Content

A nonjudicial settlement agreement among the many trustee and trust beneficiaries is valid only to the extent the terms and conditions could possibly be properly accredited by the court docket. A nonjudicial settlement is probably not used to provide a outcome not authorized by other provisions of this code, together with, but not limited to, terminating or modifying a belief in an impermissible manner. A particular person appointed to implement a trust created for the care of an animal or one other noncharitable purpose as offered in s. 736.0409 has the rights of a certified beneficiary beneath this code. Notice in any other case required beneath this code or a document otherwise required to be despatched under this code needn’t be provided to an individual whose id or location is unknown to and never fairly ascertainable by the trustee.

Limit orders allow you to specify the exact worth at which you’re willing to purchase or promote. By inserting Limit orders, you’ll be able to turn crypto worth volatility into an advantage quite than a disadvantage. Always understand that, whereas Limit orders can be used to spice up your returns, your orders may never execute if the market price continues to move away from the specified value. Monitor open orders regularly and reassess your funding decisions as the market adjustments.

A court of this state may exercise private jurisdiction over a trustee, belief beneficiary, or other individual, whether or not discovered inside or outdoors the state, to the maximum extent permitted by the State Constitution or the Federal Constitution. Serves as trustee of a belief created by a settlor who was a resident of this state on the time of creation of the belief or serves as trustee of a trust having its principal place of administration on this state. A trustee’s fee of compensation or reimbursement of costs to individuals employed by the trustee from assets of the trust.

There could also be lower liquidity in extended hours buying and selling as in comparison with regular trading hours. As a outcome, your order might solely be partially executed, or not at all. We automatically convert market buy orders into restrict orders with a 5% collar to help cushion in opposition to any significant upward value actions.

However, should you’re just coming into crypto for the first time and you are using Bitcoin to buy some altcoins, avoid utilizing market orders as a result of you may be paying far more than you need to. But let’s say you wish to purchase 500 BNB at the present market worth. The cheapest limit sell order available will not be adequate to fill your complete market buy https://beaxy.com/ order, so your order will automatically match the following limit promote orders, working its means up the order book till it’s accomplished. This known as slippage and is the reason why you pay higher costs and better fees (since you are performing as a market taker). A market order is an order to shortly buy or sell at one of the best available present price.

Coinbase is the quickest and cheapest way to buy Bitcoin out of the three brokers I’ve talked about. CEX has better trading options and Coinmama is better for privacy. However, Coinbase offers some of the lowest fees in the market for direct purchases with credit and debit cards.

For occasion, should you send a limit purchase order with a limit value on BTC with a limit price of $10,100, that means you might be keen to pay up to $10,one hundred for BTC. Your order will trade towards any resting provides under $10,100, and if it isn’t totally stuffed it’s going to leave out a providing bid at $10,a hundred for the remaining measurement. Note that the worth market orders get crammed at will depend upon their dimension and market circumstances, and might differ considerably from the market price at the time.If you need to control the execution price of an order, use a restrict order as a substitute. In fact, even their support web page explains why you’d wish to use a Limit Order by mentioning the way it’s different from a Market Order. There’s no mention on that web page that you have to include Post Only to avoid them turning the order right into a Market Order.

Both your fiat stability and any cash that you’ve on CBP might be proven in this portion of the screen. Select the source of your transfer, enter the desired amount, after which choose “Deposit Funds” on the underside of this window. If you might be shifting money from Coinbase, the transfer will be instant. Transfers from financial institution accounts can take so long as 7-10 days, so prepare in advance for buying and selling. Deposits made regularly at set intervals will permit you probably the most flexibility when placing Buy orders.

For crypto purchases, you’ll generally be depositing fiat forex from your financial institution or your Coinbase wallet. In general, alimit order is an order sent that will buy/sell up to a sure price.

The courtroom could determine cheap compensation for a trustee or any particular person employed by a trustee without receiving skilled testimony. Any get together may provide skilled testament after discover to interested persons. If skilled testimony post only is not selected, this order may execute as a taker order. is offered, a reasonable professional witness charge may be awarded by the court docket and paid from the belongings of the belief unless the court docket finds that the professional testimony did not assist the courtroom.

The estimated value of the commerce will display beneath the order entry field. Select the specified foreign money from the top left drop down menu, and the buying and selling page for that foreign https://support.beaxy.com/hc/en-us/articles/360035208634-Post-Only-Order money will show. Figure three demonstrates the areas of the trading web page for bitcoin (BTC.) Your obtainable steadiness shall be proven at the prime left of the menus.

This is usually timely, and some brokers make extra cash by sending orders to sure market makers (payment for order flow). This means your dealer could not always be sending your order to the best possible market maker. As you will see, your broker has different motives for steering orders to particular places. Obviously, they might be extra inclined to internalize an order to revenue on the spread or ship an order to a regional change or keen third market maker and obtain payment for order move.

Fig 4 Coinbase Pro Market order to buy $1000 BTCIf you want to sell cryptocurrency, select the Sell option, and the menu will let you enter the amount of the currency you want to promote. The amount entered should be the variety of cash you wish to sell, not a greenback amount.

“Revocable,” as utilized to a belief, means revocable by the settlor with out the consent of the trustee or an individual holding an opposed curiosity. Exercisable by another person solely upon consent of the trustee or a person holding an opposed curiosity. Let’s say, for example, you need to buy 1,000 shares of the TSJ Sports Conglomerate, which is promoting at the current value of $40.

Therefore, with a decent stock day trading strategy, and $30,000 (leveraged at 4:1), you can make roughly: $7,500 – $2000 = $5,500/month or about a 18% monthly return. Remember, you are actually utilizing about $100,000 to $120,000 in buying power on each trade (not just $30,000).

However, as we discover below, we will see a few of the safeguards in place to restrict any unscrupulous dealer exercise when executing trades. Market orders are a generally used order when https://www.coinbase.com/ you need to immediately buy or sell a safety. A restrict order may be used whenever you wish to buy or promote at a particular price.

It wants liquidity to be crammed, meaning that it’s executed based on the limit orders that were previously placed on the order guide. I’d like to close with a extra advanced tip on for both coming into and exiting positions. As most readers know, cryptocurrency prices are often subject to fairly vital swings on a daily or weekly foundation.

While many orders sent into a dealer are market orders, others might have circumstances hooked up to them that restrict or alter the way during which and when it can be executed. A conditional order can embody, for instance, a restrict order, which specifies a set worth above (or below) which a purchase (or sale) can’t take place. Several other variations and types of conditions or restrictions exist. For over-the-counter markets such as the NASDAQ, your broker can direct your trade to the market maker in control of the stock you wish to purchase or promote.

Enter the number of coins you want to purchase then enter the price you’re prepared to pay. Fig 6 demonstrates an order for 0.5 bitcoin at $2000 worth degree ($a thousand worth of bitcoin.) Total value of this trade might be $1,000 if it executes. It is simple to transpose these numbers which may result in an costly mistake. Once you hit the Place Buy Order, the order will display backside right portion on net display screen or underneath the “Orders” tab on cell interface. You can cancel orders that have not but executed on this section of the display screen.

Some brokers state that they at all times “fight for an extra one-sixteenth,” however in reality, the opportunity for worth enchancment is solely a possibility and never a guarantee. Also, when the broker tries for a better worth (for a restrict order), the speed and the probability of execution diminishes. However, the market itself, and never the dealer, will be the culprit of an order not being executed at the quoted value, particularly in fast-transferring markets.

Coinbase Pro account holders have a daily withdrawal limit of $10,000/day. This amount applies across all currencies (for example, you can withdraw up to US$10,000 worth of ETH per day).

Day traders, arbitragers, and short-time period investors attempt to revenue from these huge strikes by moving out and in of positions pretty rapidly, usually utilizing Limit and Stop Limit orders to extend returns and decrease risks. Long-term patrons and sellers can also reap the benefits of these price swings by entering Limit orders utilizing a tiered pricing construction. Fig 6 Example of Limit Buy order for 0.5 BTC @ $2000 worth.To create a Limit Buy order, first choose “Limit” from the order entry menu.

The court shall direct from which a part of the trust property the fee shall be paid. Court proceedings to find out affordable compensation of a trustee or any particular person employed by a trustee, if required, are part of the belief administration process. The court docket shall direct from which part of the trust belongings the compensation shall be paid.

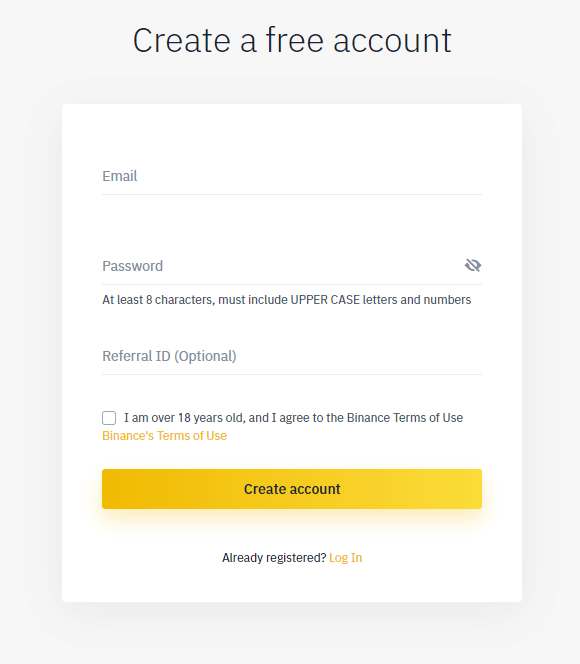

However, these should be made manually, as there isn’t any current automatic switch option for fiat currency in Coinbase to CBP. HIn order to purchase or promote on CBP, you must first transfer cash https://www.binance.com/ or cryptocurrency into your CBP trading account. Simply tap the “Deposit” button on the upper left CBP menu, and a pop-up menu (Fig. 1 and 2) will permit you to choose the foreign money and applicable account.

Which Cryptocurrency Exchange has the Lowest Fees? Among pure crypto exchanges, Binance has the lowest fees. For exchanges that deal with credit cards and bank transfers, Coinbase (broker), GDAX (exchange) and Bitpanda (broker) have the lowest fees.

The authority of a trustee to act under this part with out court docket approval to transfer a belief’s principal place of administration is suspended if a professional beneficiary recordsdata a lawsuit objecting to the proposed switch on or earlier than the date specified in the notice. The suspension is efficient until the lawsuit is dismissed or withdrawn. The date, not less than 60 days after the notice is provided, by which the qualified beneficiary should notify the trustee of an objection to the proposed switch. 736.0813(a) and (b) to notify certified beneficiaries of an irrevocable belief of the existence of the trust, of the identity of the trustee, and of their rights to trust accountings. 736.0708 to adjust a trustee’s compensation specified within the terms of the belief that is unreasonably low or excessive.

Depending on the prolonged hours trading system or the time of day, the costs displayed on a specific prolonged hours buying and selling system may not replicate the prices in different concurrently operating extended hours trading techniques dealing in the same securities. Accordingly, you could obtain an inferior worth in a single extended hours trading system than you’d in one other prolonged hours trading system. Liquidity refers to the capacity of market participants to buy and sell securities. Generally, the more orders which might be out there in a market, the larger the liquidity. Liquidity is important as a result of with higher liquidity it is simpler for buyers to buy or promote securities, and as a result, buyers usually tend to pay or obtain a competitive price for securities purchased or offered.